Knowledge Network

- drkhalidi

- Nov 18, 2020

- 5 min read

Two decades ago, if you and I were having coffee in a restaurant and heard someone talking about ecosystems and network effects, we would presume that he or she was working at either National Geographic or an Internet service provider company. Today, if we hear someone using the same phrases, we will assume that the person is an entrepreneur, venture capitalist, or executive at a tech company.

Underneath the perception’s change, lie two decades of transformation in the foundations of the business landscape. John Hagel elegantly articulated the transformation as moving from a world of push to a world of pull (The Power of Pull), and Sangeet Paul Choudary portrayed the transformation as the shift from pipes to platforms (Platform Scale).

Both ecosystems and network effects are among the pillars underpinning the 21st century’s paradigm shift in our economic fundamentals. Yet, it is shocking to see how (anemically) the giants of the business world (e.g., FAANG) communicate the strategic importance behind ecosystems and network effects to their stakeholders.

The table below shows you the number of times the FAANG companies explicitly used the words ecosystems and network effects in their 2019 Annual Reports.

How can we reconcile the above anemic numbers (lack of numbers) with the tons of publications that glorify ecosystems and network effects? We cannot do so until we stop viewing ecosystems and network effects as mere phenomena: we must see them via their creators’ mindsets.

Their creators’ mindsets digest ecosystems and network effects as integral elements of their products and services. They are embedded in their day-to-day decision-making processes (managing them, controlling them, and shaping them). As such, you will never hear them talking about their ecosystems and network effects separately or abstractly.

Microsoft is a bit more explicit in its official language when it comes to the ecosystem and network effects: Microsoft sees them in a co-creation context, which summarizes my whole point. Extract from Microsoft’s 2019 Annual Report (Form 10-K).

Establishing ecosystems is beyond this post’s scope. Yet, I can refer you to a resource that will revolutionize your ecosystem’s thinking: please read Performance Ecosystems.

From this point onward, let us embrace the creators’ mindsets to create new network effects.

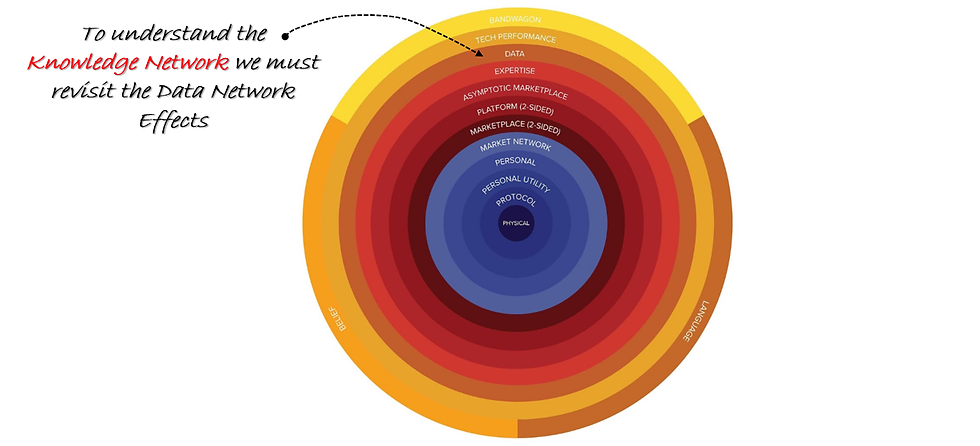

To create new network effects, we must first hack into the network effects universe; I couldn’t find a better place than James Currier’s network effects map (the NFX should be among your main domains for understanding network effects).

Our new network effects are called the knowledge network effect, or “knowledge network.” If you look at the network effects map, you will immediately make a verbal connection between “knowledge” as in knowledge network and “data” as in the data network effects. Thus, to understand the knowledge network, we need to slightly examine the data network effects (“DNE”).

The main properties of the DNE include the following:

DNE are central to the value propositions.

They benefit the central database (i.e., the platform) first, and the remaining of the benefits get channeled to the users.

Typically, DNE become asymptotes after a certain threshold: at which time, the value of having one more ounce of data results in diminishing return.

DNE must continuously get updated, which means users must spend more time (effort) using the value proposition to produce more data.

Data aggregation is a must: the DNE always has a minimum threshold to start yielding tangible values.

Data is capture driven: the essence is to hunt more data; differentiating the quality (true or false) of data is secondary.

The knowledge network is the exact opposite of the above:

It is not central to any distinct value proposition.

It directly flows to the users: almost 100% of the value directly goes to the users’ benefits.

The knowledge network never becomes asymptotic.

It does not need constant (algorithmic) updates: users are encouraged to spend less time by design.

Unlike data, knowledge is inherently valuable in isolation (it does not need to get aggregated).

Based on knowledge flow: Only the relevant knowledge makes it to the surface and nothing else.

You have probably heard the phrase “Come for the tool, stay for the network,” or its opposite. The knowledge network is built on different ideologies: you don’t come for anything and you don’t have to stay for anything. Instead, the knowledge will come to you as long as you need it.

Have you ever heard Clayton Christensen’s story with Andy Grove? If not, please check it out here (from minutes 4:50 to 6:55). These two minutes are the spark behind the knowledge network. The ripple effects of Christensen’s wisdom keep inspiring us, even when he is no longer with us.

As you can see, obstacles are always in the path of knowledge. To this day, despite exponential technological improvements in connectivity, the above two worlds (thought leaders and business leaders) are still innovating, albeit in a fragmented fashion. As such, day after day, we realize the importance of Hagel’s call to action;

Now let us unpack the core of the knowledge network.

The first unique feature that distinguishes the knowledge network from other types of network effects is that the network is the value proposition: the knowledge network is not separate from the product/service. Be it a one-to-one, one-to-many, or many-to-one interaction, people interact to obtain knowledge. In other words, people access the knowledge network to gain knowledge and leave the network once the requested knowledge is acquired. Having a value proposition that is, in itself, a “network effect” will redefine the interplays between growth and defensibility.

Moreover, the knowledge network is immune to the duality of destination vs. distribution, simply because in the knowledge network, “the value proposition” resides in your pocket: an updated version of your phone book (a universal phone book) that enables people to connect quickly and frictionlessly.

It will help to visualize placing the knowledge network in a black box. The objective of the black box is to safeguard the flow of knowledge between the relevant parties (what happens in the black box stays in the black box).

To streamline the flow of knowledge, the black box will:

- Commoditize Time: For example, an executive can call business thinkers at any time based on their availability, regardless of working hours’ limitation.

- Commoditize Payment: This is like the prepaid card concept (here, you buy time in advance and then spend your time as per your need with whom you wish).

- Modularize Access: Because of the payment commoditization technique, you can access a Nobel prize winner the same way you reach your friend.

- Differentiate the Knowledge Flow: leveraging on the above, you can engage in a frictionless way to obtain and share knowledge.

This black box consists of three interdependent stacks (applying Hagel’s unbundling the corporation concept), with each stack representing a full-fledged business.

The customer relationship stack is responsible for on-boarding the supply and demand sides, handling logistics, disputes, and conflict resolutions, and much more (we will cover the other two stacks in part II of this journey).

Now, lean back and imagine yourself (as an entrepreneur) coming up with a revolutionary technology that can detect COVID-19 in the air or on any surface and terminate it immediately. Andreessen Horowitz approaches you to fund your unicorn startup. To ensure that you have access to any needed knowledge, both Marc and Ben make sure to register you in the black box and buy you ten hours of “knowledge flow” worth $10,000.

When you need professional help, you grab your smartphone and reach the experts: in your case, they are Alex Osterwalder, Eric Ries, and Steve Blank.

You type in their names, and the black box displays their availability, hourly rates, etc. With a click, the black box starts ringing. The same ringing on the other side means guaranteed (hourly rate) money: the moment Alex, Eric, or Steve answers the call, their hourly rates get debited from your balance and credited into their accounts.